The Wall Street Journal had a piece today from Stan Liebowitz discussing foreclosures –

http://online.wsj.com/article/SB124657539489189043.html

He points out that “the single most important factor (for foreclosures) is whether the homeowner has negative equity in a house.” Over 30% of homes with mortgages now have “Negative Equity”.

Read the article. It reinforces my points that it is folly to try and use policy to prop up prices via artificially low interest rates – if somebody can’t afford the home they are in and the mortgage is worth more than their house, then they are going to walk and rent the house across the street for less money than they are paying on their mortgage.

It still cost twice as much to buy a house in my neighborhood than it does to rent the same house. Until prices get more realistic relative to rent, real estate will not work.

The longer you try and hold off the inevitable, the longer the economy stays in the toilet. The more you try and print money to artificially prop up asset prices, the deeper your currency with crash and the more basic necessities will cost the consumer.

All they had to do was take over a few banks and write all of this bad debt off and we would now be 8 months into recovery. However, the banks rule Washington, so the stupidity continues.

Friday, July 3, 2009

Is a New Stimulus Coming?

From Paul Krugman’s NY Times Op Ed yesterday –

“So here’s my message to the president: You need to get both your economic team and your political people working on additional stimulus, now. Because if you don’t, you’ll soon be facing your own personal 1937.”

http://www.nytimes.com/2009/07/03/opinion/03krugman.html?_r=1

Do you remember when Krugman called the 50 US Governors “50 little Hoovers”?

What he meant was this – because States are forced to balance their budgets, when they run deficits, they are forced to lay off workers. These layoffs lead to higher unemployment and slower economic activity.

Krugman thinks that it is better to borrow money to employ excess workers than it is to do layoffs. In my opinion, this line of thinking is moronic – but it benefits the Unions, so Obama will probably be all over it.

My guess is still that the next “Stimulus” will be a round of financing for State and Municipal governments. The Feds will either guarantee new Muni’s (ala Barney Frank) or use Federal Funds to pay for State spending. Expect the new plan to cost another cool $1 trillion or so… Also expect some sort of crisis to be used to drive Public Opinion into the camp of approving a new round of “Stimulus”.

Peter Boockvar made it clear that this new money creation will lead to inflation and inceased prices for gold and Commodities.

“So here’s my message to the president: You need to get both your economic team and your political people working on additional stimulus, now. Because if you don’t, you’ll soon be facing your own personal 1937.”

http://www.nytimes.com/2009/07/03/opinion/03krugman.html?_r=1

Do you remember when Krugman called the 50 US Governors “50 little Hoovers”?

What he meant was this – because States are forced to balance their budgets, when they run deficits, they are forced to lay off workers. These layoffs lead to higher unemployment and slower economic activity.

Krugman thinks that it is better to borrow money to employ excess workers than it is to do layoffs. In my opinion, this line of thinking is moronic – but it benefits the Unions, so Obama will probably be all over it.

My guess is still that the next “Stimulus” will be a round of financing for State and Municipal governments. The Feds will either guarantee new Muni’s (ala Barney Frank) or use Federal Funds to pay for State spending. Expect the new plan to cost another cool $1 trillion or so… Also expect some sort of crisis to be used to drive Public Opinion into the camp of approving a new round of “Stimulus”.

Peter Boockvar made it clear that this new money creation will lead to inflation and inceased prices for gold and Commodities.

Wednesday, July 1, 2009

Inflation it is a Coming

Today, people who are current on their Mortgages from Freddie Mac and Fannie Mae can now refinance at up to 125% of the current value of their house. No, that is not a misprint…

This is the endgame to Obama bringing in yet another Wall Street clown to run the Fed – Geithner. I warned you this was coming. Just keep kicking the can down the road. China is pissed.

http://www.cnbc.com/id/31685244

Here is a chart of the delinquency rates for mortgages by year of origination. As you can see, the delinquency rates for 2007 and 2008 are parabolic. Not a good sign if you are a lender… Freddie and Fannie are lending on behalf of the US Taxpayer.

I think the average default rate for defaulted mortgages that were restructured last year is already above 50%. It might be 60%, I am not certain. I am certain that a lot of those were factored into this chart.

Why is The Fed Doing This (with our money)?

Housing prices have imploded and that has put a lot of homeowners in a position of Negative Equity (your mortgage is worth more than your house).

This chart of inflation-adjusted housing prices is what is referred to as an “Eiffel Tower Top” – straight up and straight down.

The implosion in housing prices has made it impossible for homeowners with negative equity to refinance their homes. Think of all the people who have variable rate mortgages that will reset to much higher rates in 2009 – 2011. They are toast if they can’t refinance. That is an enormous pile of losses that will bankrupt a lot of banks.

Look at how many people now have negative equity (Loan to value > 100%)! If housing prices still have farther to fall (The chart above shows you that prices can still fall another 30% before reaching their historic levels of affordability.

Mortgages are now an incredibly large part of the Bond Market. That means that they are owned by lots of Pension Plans, Mutual Funds, Insurance Companies, Banks and Individual Investors. The Fed feels compelled to not allow these bonds to default and is now going to refinance existing loans at any cost.

The Fed is already buying Mortgages from those same investors. They have already bought nearly $970 billion of them. Notice the maturity dates of these purchased mortgages. They are all fairly short term paper (6 years or less). That means the Fed has been buying variable mortgages – the toxic crap that is virtually worthless.

There is no way to know exactly what was paid for it, but you can bet the boys at PIMCO and Blackrock made a killing. The Fed will now try and refi a huge percentage of this debt via this new program.

You are probably wondering why this is such a bad idea – I mean it keep people in their houses, right?

I’m just going to do the math to show you how what the Fed is doing is propping up real estate prices for as long as they can.

Say you have a $100,000 ARM and it will recast in 2009. Your current Interest Rate is 4% and it will recast at 9%.

Your current monthly payment is $333

Your monthly payment starting in January 2010 will be $804

But Uncle Sam has been artificially holding rates down by buying $960 billion in Mortgages and another $330 billion in US Treasuries to help you refi at these below-market rates.

So you can now refi at 5.3% on a 30-year Fixed and have a monthly payment of only $555 per month. That is a lot more than $333, but it will allow a lot of people to stay in their houses.

Is that a Good Thing?

The claim is that the Government is doing this to make housing “more affordable” – bs.

How do you make things more affordable by making credit artificially cheap?

If I make $100k and I want to buy a house, the old matrix was that I could spend 28% of my income on the cost of housing (mortgage, insurance and taxes). The average now is 40% - even after the collapse in housing prices.

That would mean that at a 7% interest rate (where things would probably be right now without Government intervention in the Credit Market), I would be able to buy a house worth $435k.

However, at 5.3%, I would be able to buy a home worth $521,100. The lower rates are artificailly propping up prices by 20%. How the heck does capping Interest Rates make housing more affordable? It doesn’t, of course.

My concern is that some yutz is going to refi a house he can’t afford at 125% Loan to Value and the poor slob will spend the rest of his life as a slave to his house. The bankers will get rich, yet again.

The whole point of all of the Mortgage Mod Plans and Purchase Plans is to try and get cash into the hands of consumers – just like they did it is 2003. You can see how the Fed is creating a Credit Bubble that is several times larger than the one that just popped.

The issue for me is that the last go around, the bonds were purchased by Hedge Funds and Banks – now they are being bought by the US Treasury and US Agencies (SIVs to the US Government Balance Sheet). The Dollar is toast - it is simply a matter of when, not if. Your Dollar-denominated asset (like Real Estate) are going to get crushed... You had better find ways of hedging for a falling Dollar.

So how is this all going to end?

I came across an interview of Peter Boockvar today on Bloomberg (ht zerohedge). This is not me being interviewed, but he sure uses a lot of my phrases.

http://www.clipsyndicate.com/video/play/1004277

“Inflation is the symptom of a weak currency.”

“There’s this Global race to debase one’s currency, in order to inflate our way out of this mess. Gold is a beneficiary of that.”

The market is “betting" that inflation “will come”.

“Ben Bernanke and the Fed are not going to stop, until this economy gains traction.”

“If the economy gets better, then inflation is going to follow us like this dark shadow.”

“The S&P 500 is up 15% since the middle of March. The CRB Index (Commodities) is up 15%. So on an inflation adjusted term, the market has done nothing since the middle of March. This is an inflation-type rally, egged on by the Fed’s Quantitative Easing and printing of money.”

“There are 3 different ways of dealing with the debt that we have – you can pay it down, you can write it off or you can inflate your way out. The Fed has chosen the third (I have been saying exactly the same thing for years).”

“By inflating your way out – by artificially keeping rates low, you’re preventing the deleveraging process from occurring. If I cut rates to zero, you’re not going to pay down debt - you’re just going to refinance it. You’re going to push it out to 2012, instead of 2010. WE ARE KICKING THE CAN DOWN THE ROAD (capitalized by me for emphasis). That’s what the Fed is doing.

We need to extinguish debt in this country… but all we are doing is refinancing – a loan modification. It’s just a refinancing .

People should be renting, that can’t afford to live in (an existing home). We are kicking the can down the road. It’s going to be good for Gold, because there is going to be constantly more printing of money.”

“We’ve seen a pullback in spending because demand is not there. The economy needs to readjust. So, the Government is trying to put Humpty Dumpty back together again (I know I wrote this line in several previous posts). And it’s not going to happen. Because the consumer can’t handle any more debt, businesses can’t handle any more debt and right now the government can – because foreigners and investors are buying it, but who knows how much longer that will last.”

“We are on a dangerous path right now and unfortunately, I don’t think the Fed fully understands. They are living in this World where there’s Deflation – Janet Yellen last night said that she’s more worried that inflation is going to stay low for years. Gold is 7% from $1,000 and you have a Fed member who is saying that Inflation is not a concern… One of them will be wrong.

I love this guy. I will be reading him in the future and linking what I think is beneficial.

China wants a new reserve currency to be brought up at the next G8 meeting. I have news for them, we already have one – and it is called Gold.

This is the endgame to Obama bringing in yet another Wall Street clown to run the Fed – Geithner. I warned you this was coming. Just keep kicking the can down the road. China is pissed.

http://www.cnbc.com/id/31685244

Here is a chart of the delinquency rates for mortgages by year of origination. As you can see, the delinquency rates for 2007 and 2008 are parabolic. Not a good sign if you are a lender… Freddie and Fannie are lending on behalf of the US Taxpayer.

I think the average default rate for defaulted mortgages that were restructured last year is already above 50%. It might be 60%, I am not certain. I am certain that a lot of those were factored into this chart.

Why is The Fed Doing This (with our money)?

Housing prices have imploded and that has put a lot of homeowners in a position of Negative Equity (your mortgage is worth more than your house).

This chart of inflation-adjusted housing prices is what is referred to as an “Eiffel Tower Top” – straight up and straight down.

The implosion in housing prices has made it impossible for homeowners with negative equity to refinance their homes. Think of all the people who have variable rate mortgages that will reset to much higher rates in 2009 – 2011. They are toast if they can’t refinance. That is an enormous pile of losses that will bankrupt a lot of banks.

Look at how many people now have negative equity (Loan to value > 100%)! If housing prices still have farther to fall (The chart above shows you that prices can still fall another 30% before reaching their historic levels of affordability.

Mortgages are now an incredibly large part of the Bond Market. That means that they are owned by lots of Pension Plans, Mutual Funds, Insurance Companies, Banks and Individual Investors. The Fed feels compelled to not allow these bonds to default and is now going to refinance existing loans at any cost.

The Fed is already buying Mortgages from those same investors. They have already bought nearly $970 billion of them. Notice the maturity dates of these purchased mortgages. They are all fairly short term paper (6 years or less). That means the Fed has been buying variable mortgages – the toxic crap that is virtually worthless.

There is no way to know exactly what was paid for it, but you can bet the boys at PIMCO and Blackrock made a killing. The Fed will now try and refi a huge percentage of this debt via this new program.

You are probably wondering why this is such a bad idea – I mean it keep people in their houses, right?

I’m just going to do the math to show you how what the Fed is doing is propping up real estate prices for as long as they can.

Say you have a $100,000 ARM and it will recast in 2009. Your current Interest Rate is 4% and it will recast at 9%.

Your current monthly payment is $333

Your monthly payment starting in January 2010 will be $804

But Uncle Sam has been artificially holding rates down by buying $960 billion in Mortgages and another $330 billion in US Treasuries to help you refi at these below-market rates.

So you can now refi at 5.3% on a 30-year Fixed and have a monthly payment of only $555 per month. That is a lot more than $333, but it will allow a lot of people to stay in their houses.

Is that a Good Thing?

The claim is that the Government is doing this to make housing “more affordable” – bs.

How do you make things more affordable by making credit artificially cheap?

If I make $100k and I want to buy a house, the old matrix was that I could spend 28% of my income on the cost of housing (mortgage, insurance and taxes). The average now is 40% - even after the collapse in housing prices.

That would mean that at a 7% interest rate (where things would probably be right now without Government intervention in the Credit Market), I would be able to buy a house worth $435k.

However, at 5.3%, I would be able to buy a home worth $521,100. The lower rates are artificailly propping up prices by 20%. How the heck does capping Interest Rates make housing more affordable? It doesn’t, of course.

My concern is that some yutz is going to refi a house he can’t afford at 125% Loan to Value and the poor slob will spend the rest of his life as a slave to his house. The bankers will get rich, yet again.

The whole point of all of the Mortgage Mod Plans and Purchase Plans is to try and get cash into the hands of consumers – just like they did it is 2003. You can see how the Fed is creating a Credit Bubble that is several times larger than the one that just popped.

The issue for me is that the last go around, the bonds were purchased by Hedge Funds and Banks – now they are being bought by the US Treasury and US Agencies (SIVs to the US Government Balance Sheet). The Dollar is toast - it is simply a matter of when, not if. Your Dollar-denominated asset (like Real Estate) are going to get crushed... You had better find ways of hedging for a falling Dollar.

So how is this all going to end?

I came across an interview of Peter Boockvar today on Bloomberg (ht zerohedge). This is not me being interviewed, but he sure uses a lot of my phrases.

http://www.clipsyndicate.com/video/play/1004277

“Inflation is the symptom of a weak currency.”

“There’s this Global race to debase one’s currency, in order to inflate our way out of this mess. Gold is a beneficiary of that.”

The market is “betting" that inflation “will come”.

“Ben Bernanke and the Fed are not going to stop, until this economy gains traction.”

“If the economy gets better, then inflation is going to follow us like this dark shadow.”

“The S&P 500 is up 15% since the middle of March. The CRB Index (Commodities) is up 15%. So on an inflation adjusted term, the market has done nothing since the middle of March. This is an inflation-type rally, egged on by the Fed’s Quantitative Easing and printing of money.”

“There are 3 different ways of dealing with the debt that we have – you can pay it down, you can write it off or you can inflate your way out. The Fed has chosen the third (I have been saying exactly the same thing for years).”

“By inflating your way out – by artificially keeping rates low, you’re preventing the deleveraging process from occurring. If I cut rates to zero, you’re not going to pay down debt - you’re just going to refinance it. You’re going to push it out to 2012, instead of 2010. WE ARE KICKING THE CAN DOWN THE ROAD (capitalized by me for emphasis). That’s what the Fed is doing.

We need to extinguish debt in this country… but all we are doing is refinancing – a loan modification. It’s just a refinancing .

People should be renting, that can’t afford to live in (an existing home). We are kicking the can down the road. It’s going to be good for Gold, because there is going to be constantly more printing of money.”

“We’ve seen a pullback in spending because demand is not there. The economy needs to readjust. So, the Government is trying to put Humpty Dumpty back together again (I know I wrote this line in several previous posts). And it’s not going to happen. Because the consumer can’t handle any more debt, businesses can’t handle any more debt and right now the government can – because foreigners and investors are buying it, but who knows how much longer that will last.”

“We are on a dangerous path right now and unfortunately, I don’t think the Fed fully understands. They are living in this World where there’s Deflation – Janet Yellen last night said that she’s more worried that inflation is going to stay low for years. Gold is 7% from $1,000 and you have a Fed member who is saying that Inflation is not a concern… One of them will be wrong.

I love this guy. I will be reading him in the future and linking what I think is beneficial.

China wants a new reserve currency to be brought up at the next G8 meeting. I have news for them, we already have one – and it is called Gold.

Monday, June 29, 2009

Mor on California

I have had a couple of questions today about Municipal Bonds and the potential for a Default by California on its debt. From what I have read, California cannot default on its Municipal Bonds, nor can it just stop paying its education bills. However, California can stop making payments to counties and cities and they can be forced to default on their debt.

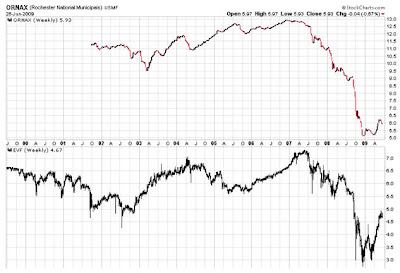

Here is a chart of a mutual fund holding Municipal Bonds from around the nation. I compare this fund to the chart of the 30-year US Treasury, because it gives you a clear picture of how the market perceives the credit quality of the Fund versus the “safe” US Treasury.

When the Credit Markets cracked in September 2008, this fund tanked and US Treasury when vertical. The trends reversed at the end of 2008 and the US Treasury now sits at a significant support level.

I am more inclined to buy treasuries here, than sell. Therefore, I would be more inclined to sell Muni’s than buy.

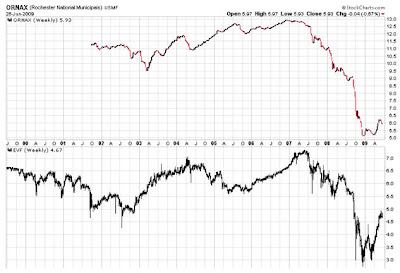

You second type of municipal bond fund shows some gruesome performance. It is basically what is referred to as a “floating rate” fund. These funds how high-yield (junk) bonds, whose interest rates reset every 30 days. They tend to get trashed during recessions and then have decent returns as interest rates increase during economic expansion. I am not sure how much upside they will have in this recovery.

I have included a chart of a corporate “floating rate fund” (EVF) for comparison. EVF has rallied 60% since the March 2009 lows – I don’t think there is much upside over the near term.

The bottom line is this – California can issue a lot of new bonds any time it wants. It will simply have to offer the bonds at interest rates substantially above where they are now. The Fed is artificially holding rates down by printing money, because nobody in their right mind is willing to buy bonds at these current interest rates. Just something to consider if you own a lot of Muni Bonds…

Here is a chart of a mutual fund holding Municipal Bonds from around the nation. I compare this fund to the chart of the 30-year US Treasury, because it gives you a clear picture of how the market perceives the credit quality of the Fund versus the “safe” US Treasury.

When the Credit Markets cracked in September 2008, this fund tanked and US Treasury when vertical. The trends reversed at the end of 2008 and the US Treasury now sits at a significant support level.

I am more inclined to buy treasuries here, than sell. Therefore, I would be more inclined to sell Muni’s than buy.

You second type of municipal bond fund shows some gruesome performance. It is basically what is referred to as a “floating rate” fund. These funds how high-yield (junk) bonds, whose interest rates reset every 30 days. They tend to get trashed during recessions and then have decent returns as interest rates increase during economic expansion. I am not sure how much upside they will have in this recovery.

I have included a chart of a corporate “floating rate fund” (EVF) for comparison. EVF has rallied 60% since the March 2009 lows – I don’t think there is much upside over the near term.

The bottom line is this – California can issue a lot of new bonds any time it wants. It will simply have to offer the bonds at interest rates substantially above where they are now. The Fed is artificially holding rates down by printing money, because nobody in their right mind is willing to buy bonds at these current interest rates. Just something to consider if you own a lot of Muni Bonds…

Subscribe to:

Comments (Atom)