How many times do you think we will hear the word “confidence” over the next two days?

I want to do a comprehensive post today, because tomorrow should be a pretty meaningful day.

Where Are We Now?

According to Bloomberg, so far the US Government has spent or committed $9.7 Trillion stabilizing the stock and bond markets and the Banking System. That is not a typo. $8 trillion is money that has been committed without a single vote by a single elected official. And the Government won’t tell us how they have spent most of this money.

http://www.bloomberg.com/apps/news?pid=washingtonstory&sid=aGq2B3XeGKokI did a post a while back showing how each time the markets started to break support, the Government would announce a new plan to spend $300 billion or so and the markets would bounce for several hundred points and remain in their trading ranges. This game continues.

http://nbcharts.blogspot.com/2008/12/2008-busy-year.htmlWhy Are We Here?Because the Banking System was allowed to get too over-leveraged and is now insolvent. The repeal of Glass-Steagall in 1999 allowed Investment Banks to own Banks. That meant that the creators of Risk now were coupled with the creators of Capital (via increasing Debt). So, by definition, if you prevent additional Debt creation, then you prevent bank revenue. Therefore, banks have an incentive to reduce risk management and increase Debt issuance. Banks increase Leverage until they either are stopped by the Government or their hand is forced by falling asset prices.

Investment Banks created a massive Debt Bubble (via this process), which popped and broke the back of the Economy in 1929. So the Government enacted Glass-Steagall in 1933 to separate the creators of Risk from the creators of Capital (via Debt). Those who fail to learn from the past are doomed to repeat in…

There is another big round of Mortgage Writedowns coming in the very near future. Moody's just downgraded several AAA Prime Mortgage traunces to Junk. The Banks know that they will soon have to mark down the pricing of this debt on their balance sheets and they want to sell it to a sucker while they still can. That sucker is the US Taxpayer. Thanks for changing things, Obama!

How Close Did We Get to Oblivion?If you get five minutes, then watch this CSPAN clip with Rep. Paul Kanjorski (D – Penn). After the woman is done ranting, Kanjorski tells us all how close the system was to total collapse.

http://www.liveleak.com/view?i=ca2_1234032281The bottom line is that there was a Run on the Money Market System on Sept 15, 2008 and by the end of the day, $5.5 Trillion would have been withdrawn from the system and the World Economic System would have collapsed overnight (It really would have occurred).

Moreover, he says that the UK does not have the money to buy out all the bad assets on the books of their banks. So they bought stock in the banks to buy time. He then says that if the US buys all the bad assets out of out banks, then in it will cost $3 to $4 Trillion. We bought stock in Banks via the TARP and that money is now gone, as banks have taken further losses on bad debts that are currently on their books.

His closing comments of “we are not geniuses’ (regarding economics) and “we don’t know (regarding how to solve the crisis) are not comforting.

That brings us to where we are now.

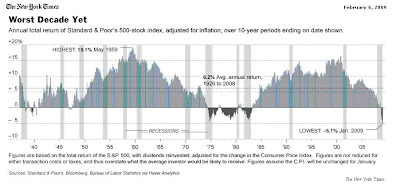

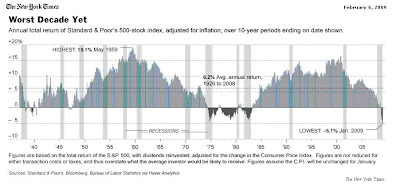

The Stock MarketAccording to the NY Times, the S&P 500 has posted its worst 10-year return (Inflation Adjusted) since at least 1930. Just wait until the end of this quarter, when the Mutual Fund Industry starts to publish 10-year returns on their funds and they are NEGATIVE!

http://www.nytimes.com/imagepages/2009/02/06/business/20090207_CHARTS_graphic.html  The Bond Market

The Bond MarketBernanke has promised to use the resources of the Fed to buy Bonds and thus cap Interest Rates. He has threatened to do this with Mortgages and with US Treasuries. But the Markets are calling his bluff. The Markets know that the Fed does not have enough money to buy all the Bonds that current holders want to sell. Therefore, rates are ramping higher again.

The Fed is buying $500 billion in mortgages to cap Interest Rates, but the market is selling off, because the market knows that the Fed will have to buy at least $5.5 trillion in order to keep rates down.

China is selling long term bonds (Treasuries and Mortgages) and is buying 3 month and 3-year treasuries. The taxpayer is on the hook for the refinancing of the debt held by the Central Bank of China, Japan et al.

China has sold $190 billion in bonds in the last 15 weeks.

$TNX is the Yield on the 10-Year US Treasury times 10 (so $TNX at 30 = 3% yield in the 10-year Treasury). What is this thing pricing in? It has gone from 2.1% to 3.1% in a few weeks!

Remember, the Bond Market is also in a Bubble which started in 1982. When it pops, there will be yet another round of Bank Failures.

Conclusion 1

Conclusion 1

So the stuff we have tried thus far has not worked. We have spent or committed to spend $9.7 Trillion and all we have to show for it is a stabilized stock market, stuck in a trading range. Oh, and the Wall Street Bankers have realized about $100 billion in bonuses at Taxpayer expense… But the Banks are still insolvent and the Credit Markets are frozen.

Mis-priced Assets

The big issue facing the Banking System right now is that Banks are lying about the value of the Bonds they currently hold on their Balance Sheets. Very simply, if the Banks were forced to accurately value the assets they hold, then they would be insolvent.

Rep Brad Miller (D – NC) stated the obvious last week, saying “If we had regulators go in an examine the books like we did at Fannie Mae and Freddie Mac a great number of our systemically important financial institutions could be insolvent."

Banks have been allowed to play this accounting game where they move assets from Level I (where pricing is transparent) to Levels II and III (where pricing is opaque), or from their Real Balance Sheets to “Off Balance Sheet Vehicles” (like SIVs), because once the assets are moved to these areas, they banks can market up the prices artificially high and declare “gains” and keep themselves looking solvent for at least one more quarter.

When Hedge Funds figured this out and started shorting banks and blogging about why they were doing so, the SEC outlawed Short Selling, instead of making the banks divulge all of their holdings and list them on their balance sheets at their real prices. The SEC made short selling illegal, refused to prosecute the criminals who were lying on their SEC Filings and then let these same criminals get huge bonuses (at taxpayer expense).

Here is a good primer on the topic –

http://www.nakedcapitalism.com/2009/02/john-paulson-attacks-fellow-hedge-funds.htmlThe New Bailout PlanThis plan will be announced Tuesday and will be a compromise of some sort, because there are two significant power struggles going on in Washington.

The NY Fed vs The FDIC

Will all of this Capital focused on Wall Street, the NY Fed is extremely powerful. So it has a vested interest to make sure that the Large Banks are not Nationalized, with their assets split up and sold to Regional Banks around the country.

The FDIC will benefit if these Large Banks are nationalized, as the FDIC would become the manager of the Bad Assets and the distributor of the Good Assets. How would you like to have the power to distributed $5 trillion of assets and $120 trillion of derivatives?

From what I am hearing, there is an internal battle within the Obama Administration, with Treasury Secretary Geithner (Former Head of the NY Fed) and Larry Summers on the side of the NY Fed and Wall Street and FDIC Head Sheila Bair and former Fed Head Paul Volcker on the side of the Taxpayer.

The US Taxpayer vs The Bank Bondholders and Shareholders

Who will pay to bail out the banks? It is clear that private industry has no desire to buy the assets off the books of the banks at their current prices. So the Government wants to force the taxpayer to buy this junk at the artificially high prices at which they currently are valued on the books of the banks.

Some people are now referring to this as the “PIMCO Bailout”. This is a reference to how the Government has been putting the Bondholder and Wall Street in front of the taxpayer. There are a couple reasons for this.

First, politicians are terrified of having another Lehman Meltdown. The bankruptcy of Lehman caused all of their debt to lose 91% of its value overnight and caused several Money Market Funds to fall below $1 per share. This led to the Run on Money Markets cited above.

Second, Bank Bonds make up a considerable percentage of the Corporate Bond market. The nationalization (de facto bankruptcy) of several large banks would cause significant harm to the portfolios of Pension, 401ks, Hedge Funds and the balance sheets of other Banks. The fear is that this would probably lead to yet another leg down in asset prices.

Third, the TARP bought a lot (about $300 billion) of Bank Preferred Stocks and the FDIC is insuring a lot of bank debt, so if you nationalize those banks, then the Fed loses all of that money overnight. Try explaining that in the next election…

Boxed Into a CornerSo the policy makers have painted themselves into a corner. They will either have to overtly harm the taxpayer via a massive bank bailout (Cost $3 – 4 Trillion) or admit to the taxpayer that they wasted $500+ Billion on the TARP and FDIC Guarantees.

The good news is that if they do have to nationalize (they do), then the consequences will not be so bad. This is because the Fed has taken steps to backstop Money Market Funds and has significantly increased levels of FDIC Insurance.

The bottom line is that Taxpayers, Stockholders and Bondholders will all have to pay to solve the problem of insolvent banks and insolvent consumers. On Tuesday, Geithner will tell us who gets hurt the most.

If it is a “Bad Bank”, where the Taxpayer gets none of the Good Assets and All of the Bad Debt, then the plan is nothing more than a several Trillion Dollar wealth transfer from Taxpayer to Bond/Stockholder.

If it is Nationalization, then the Bond/Shareholders lose and the Good Assets of the banks are used to help the Taxpayer to absorb the losses they will get stuck with as they take over the FDIC obligations of these failed banks.

I expect the Geithner Plan to be significantly weighted against the Taxpayer and in favor of his buddies at the Banks. We’ll see.