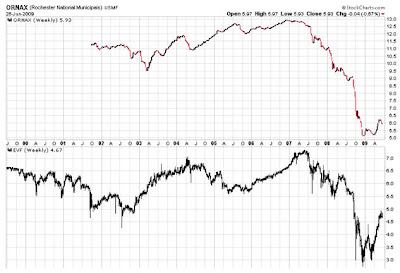

Here is a chart of a mutual fund holding Municipal Bonds from around the nation. I compare this fund to the chart of the 30-year US Treasury, because it gives you a clear picture of how the market perceives the credit quality of the Fund versus the “safe” US Treasury.

When the Credit Markets cracked in September 2008, this fund tanked and US Treasury when vertical. The trends reversed at the end of 2008 and the US Treasury now sits at a significant support level.

I am more inclined to buy treasuries here, than sell. Therefore, I would be more inclined to sell Muni’s than buy.

You second type of municipal bond fund shows some gruesome performance. It is basically what is referred to as a “floating rate” fund. These funds how high-yield (junk) bonds, whose interest rates reset every 30 days. They tend to get trashed during recessions and then have decent returns as interest rates increase during economic expansion. I am not sure how much upside they will have in this recovery.

I have included a chart of a corporate “floating rate fund” (EVF) for comparison. EVF has rallied 60% since the March 2009 lows – I don’t think there is much upside over the near term.

The bottom line is this – California can issue a lot of new bonds any time it wants. It will simply have to offer the bonds at interest rates substantially above where they are now. The Fed is artificially holding rates down by printing money, because nobody in their right mind is willing to buy bonds at these current interest rates. Just something to consider if you own a lot of Muni Bonds…

No comments:

Post a Comment