But all and all, this has been a very constructive 5-day pullback.

Intel (INTC) is doing exactly what you would want it to do. It went vertical and has since been sitting in a very narrow 5-day trading range. That is called a Bullish Pennant and has the potential to be extremely productive in a very short period of time. Notice how price moved right to rising red line and has held. That is where I expect price to hold. Look for a big, fast move (up or down) in the near term.

The NASDAQ 100 (QQQQ) has a similar pattern and this has me interested in Tech for a potential trade.

Pullbacks to the 50-day

I bought some Microsoft this week on a pullback to the 50-day, because I have seen so many stocks pull back on bad earnings, only to ramp straight back up (see DELL). I also bought some PALM at the 50-day.

Biotech (IBB) has also gone vertical. I expect it to pull an Intel very soon and wait for the Red Line to catch up to price. I am in and not selling.

Look at how Transports (IYT) has simply pulled back toward the old breakout level.

The same goes for OMG and Brazil (EZA).

I am now watching the following closely –

The markets appear to be bottoming like the topped in 2006 -2008. Namely, key sectors are now breaking out of trading ranges and through key resistance, just as key sectors broke down below key support to set up the Bear Market. Remember, the S&P 500 only broke out of its 9-month base last week!

Retail (RTH) has been sitting around at the top of its trading range for the last 5 days. I would love to see it break out from here and play catch up with Biotech and Transports and the S&P 500!

Google (GOOG) has pulled back and is sitting around, right below critical resistance.

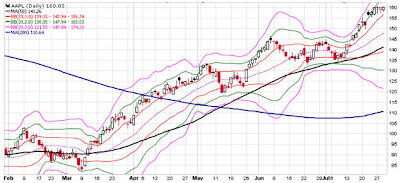

Apple (AAPL) looks like Intel. As does Cisco.

The setup is there to go higher. The markets have spent 5 days digesting the moon shot off the failed breakdown. Anything can happen, but I like what I see tonight.

No comments:

Post a Comment