I keep hearing the same words they were throwing around when they talked about Financial stocks – “Value”, “Cheap”, “Oversold”, “Bottom”… Bottoms will form over time and there is no need to jump in until institutions prove that they are looking to buy as well.

Bubbles Cause Mal-Investment

My thesis is that there is a massive supply of Oil now sitting in Oil Storage Facilities and parked in Super Tankers off many major ports. This supply is now competing directly with OPEC for a presently-diminishing number of consumers. So it doesn't really matter how much OPEC cuts supply in the near term, because there is ample supply available, without having to take any more oil out of the ground. At some point, this dynamic will change and I will be interested in OIl when it does.

The last phase of the 2002-2007 Bull Market was the bubble in Commodities and Energy. This bubble popped in early- to mid-2008. Here is a chart of the Energy Stock ETF (IYE). Look at how many shares of IYE were traded in the 1st half of 2008 (Green Box).

That was massive speculation, with buyers stepping all over each other to load up on Energy holdings. I think a lot of this was the result of Hedge Funds being allowed to lever up 6:1 or 10:1 and ramp up energy prices. West Texas Crude Oil ($WTIC) and Natural Gas ($NATGAS) went straight up.

So did Agricultural Commodities ($DJAAGT).

This was a classic bubble, where people all tried to chase returns and in the end, there was nobody left to buy. Then, the inevitable Crash soon followed.

Futures Deliveries

Because Futures Contracts ultimately end in the delivery of the underlying commodity to the owner of the contract, somebody has to figure out how to store the commodities they buy. What ended up occurring in the Commodity Bubble, was that Hedge Funds and large Investment Banks bought storage facilities and oil tankers to store their oil.

This stuff never made it into the economy – it was sitting in the SS Harvard Endowment Supertanker in the South China Sea, waiting to be sold at some future date, at some higher price.

When the bubble popped, there were no more speculators to sell to and now massive excess supply existed. The owners then started selling to consumers. So you now had this fleet of Oil Tankers and Cargo Ships full of Raw Materials, sitting in the harbors of the World’s major cities.

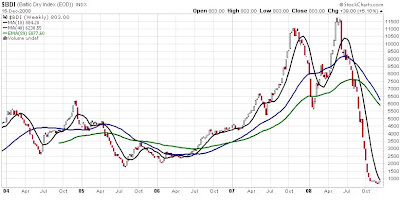

This excess supply led to price implosions and also led to implosions in the business of companies who make their money shipping raw materials – Shippers ($BDI), Pipelines ($DJUSPL) and Railroads ($DJUSRR).

The moral to the story is this – don’t go buying these sectors because some guy on TV is telling you that they are cheap. Be patient. The bottoms will take time. But they will eventually bottom and may become leaders again.

Remember how they looked at the top, because the cheap money now being printed by Central Banks is going to set up a new series of bubbles. There will come a time to buy these and then another time to sell these. I will let you know when these times arrive.

For now, here is the Energy Index (IYE). It has been consolidating for 11 weeks on contracting volume. Remember, consolidations are followed by violent moves. I expect a big move soon. I am not sure in which direction it will move, but I think I can make money on it when it arrives.

No comments:

Post a Comment