If Big Money is buying, then I need to be as well. I need to be looking for the best setups in the best companies, sectors, asset classes, commodities, currencies, countries. They took a pause for a few weeks and now appear hungry again.

I have not done a lot of posting recently, because I have been spending a lot of time studying and have had more meetings with new clients than I have ever had in my life. Throw a new company on top of that and I simply don’t have time to post much. People still seem to not believe that a recovery is possible, just as they seemed to not believe that The Crash was possible.

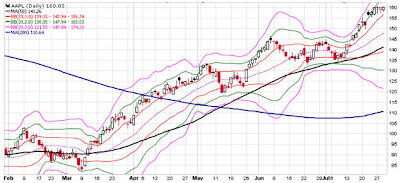

When I have posted, it has been a lot of charts of markets and stocks, because that is all that matters – what is working and what is not working. Stop Orders get me in and they get me out if I am wrong. This market has rewarded you for buying right and punished you for buying wrong.

Friday was Options Expiration, so today's move could have simply been designed to suck in money before rolling over again. We'll see. The computers are in control, so there are a lot of overshoots below support to shake you out and above resistance to suck you in. It is simply a part of the new Wall Street Machine…

Here is what I am seeing right now –

Indexes

The markets ran into key resistance (SPX 1,015) in late July and just around for a few weeks. They had every chance to fail, but there was minimal selling. Then the buyers showed up yesterday and broke the markets out of their multi-week trading ranges.

Large Growth (including the NASDAQ – QQQQ) is now at the top of its recent consolidation. Sometimes I have to buy based on chart patterns so that I can better measure my entry points. Small Cap Growth (IWO) has a similar chart.

Sectors

Metals and Mining (XME) are just hanging out. The bigger the consolidation, the more fuel for the ultimate breakout or breakdown.

Large Energy companies (XLE) are at the top of a now 11-month trading range. Oil Service (OIH) is also in a trading range, but has performed better than XLE.

Semiconductors (SMH) have been consolidating the last rally for about a month

Latin America (ILF) is also at the top of this consolidation.

Individual Companies

Red Hat (RHT), BIDU, SOHU and EMC are in Bullish Wedges

CCJ is at the top of a trading range.

Apache (APA) broke out of its 11-month range and has been sitting on top of the breakout for a month.

Teekay (TK) may be breaking out.

Commodities

Crude Oil ($WTIC) is sitting at the top of a trading range. If buyers show up, then that could light the fire under Energy Stocks.

Natural Gas is sitting at the low end of a multi-month trading range.

Gold is in a big consolidation, right below critical resistance at $1,000.

The US Dollar is the key to everything (I will post on this later). The falling Dollar has been the driver for all the risk-assets to move higher (stocks, commodities). This is the Dollar Carry Trade in action. A rise in the Dollar above 80 would most likely tank stocks and crash Emerging Market stock markets. A Dollar breakdown and then we most likely get another huge leg up in stocks and commodities. This is the goal Bernanke…

The Swiss Franc may be re-establishing itself as the non-Dollar Reserve Currency.