From Paul Krugman’s NY Times Op Ed yesterday –

“So here’s my message to the president: You need to get both your economic team and your political people working on additional stimulus, now. Because if you don’t, you’ll soon be facing your own personal 1937.”

http://www.nytimes.com/2009/07/03/opinion/03krugman.html?_r=1

Do you remember when Krugman called the 50 US Governors “50 little Hoovers”?

What he meant was this – because States are forced to balance their budgets, when they run deficits, they are forced to lay off workers. These layoffs lead to higher unemployment and slower economic activity.

Krugman thinks that it is better to borrow money to employ excess workers than it is to do layoffs. In my opinion, this line of thinking is moronic – but it benefits the Unions, so Obama will probably be all over it.

My guess is still that the next “Stimulus” will be a round of financing for State and Municipal governments. The Feds will either guarantee new Muni’s (ala Barney Frank) or use Federal Funds to pay for State spending. Expect the new plan to cost another cool $1 trillion or so… Also expect some sort of crisis to be used to drive Public Opinion into the camp of approving a new round of “Stimulus”.

Peter Boockvar made it clear that this new money creation will lead to inflation and inceased prices for gold and Commodities.

Friday, July 3, 2009

Wednesday, July 1, 2009

Inflation it is a Coming

Today, people who are current on their Mortgages from Freddie Mac and Fannie Mae can now refinance at up to 125% of the current value of their house. No, that is not a misprint…

This is the endgame to Obama bringing in yet another Wall Street clown to run the Fed – Geithner. I warned you this was coming. Just keep kicking the can down the road. China is pissed.

http://www.cnbc.com/id/31685244

Here is a chart of the delinquency rates for mortgages by year of origination. As you can see, the delinquency rates for 2007 and 2008 are parabolic. Not a good sign if you are a lender… Freddie and Fannie are lending on behalf of the US Taxpayer.

I think the average default rate for defaulted mortgages that were restructured last year is already above 50%. It might be 60%, I am not certain. I am certain that a lot of those were factored into this chart.

Why is The Fed Doing This (with our money)?

Housing prices have imploded and that has put a lot of homeowners in a position of Negative Equity (your mortgage is worth more than your house).

This chart of inflation-adjusted housing prices is what is referred to as an “Eiffel Tower Top” – straight up and straight down.

The implosion in housing prices has made it impossible for homeowners with negative equity to refinance their homes. Think of all the people who have variable rate mortgages that will reset to much higher rates in 2009 – 2011. They are toast if they can’t refinance. That is an enormous pile of losses that will bankrupt a lot of banks.

Look at how many people now have negative equity (Loan to value > 100%)! If housing prices still have farther to fall (The chart above shows you that prices can still fall another 30% before reaching their historic levels of affordability.

Mortgages are now an incredibly large part of the Bond Market. That means that they are owned by lots of Pension Plans, Mutual Funds, Insurance Companies, Banks and Individual Investors. The Fed feels compelled to not allow these bonds to default and is now going to refinance existing loans at any cost.

The Fed is already buying Mortgages from those same investors. They have already bought nearly $970 billion of them. Notice the maturity dates of these purchased mortgages. They are all fairly short term paper (6 years or less). That means the Fed has been buying variable mortgages – the toxic crap that is virtually worthless.

There is no way to know exactly what was paid for it, but you can bet the boys at PIMCO and Blackrock made a killing. The Fed will now try and refi a huge percentage of this debt via this new program.

You are probably wondering why this is such a bad idea – I mean it keep people in their houses, right?

I’m just going to do the math to show you how what the Fed is doing is propping up real estate prices for as long as they can.

Say you have a $100,000 ARM and it will recast in 2009. Your current Interest Rate is 4% and it will recast at 9%.

Your current monthly payment is $333

Your monthly payment starting in January 2010 will be $804

But Uncle Sam has been artificially holding rates down by buying $960 billion in Mortgages and another $330 billion in US Treasuries to help you refi at these below-market rates.

So you can now refi at 5.3% on a 30-year Fixed and have a monthly payment of only $555 per month. That is a lot more than $333, but it will allow a lot of people to stay in their houses.

Is that a Good Thing?

The claim is that the Government is doing this to make housing “more affordable” – bs.

How do you make things more affordable by making credit artificially cheap?

If I make $100k and I want to buy a house, the old matrix was that I could spend 28% of my income on the cost of housing (mortgage, insurance and taxes). The average now is 40% - even after the collapse in housing prices.

That would mean that at a 7% interest rate (where things would probably be right now without Government intervention in the Credit Market), I would be able to buy a house worth $435k.

However, at 5.3%, I would be able to buy a home worth $521,100. The lower rates are artificailly propping up prices by 20%. How the heck does capping Interest Rates make housing more affordable? It doesn’t, of course.

My concern is that some yutz is going to refi a house he can’t afford at 125% Loan to Value and the poor slob will spend the rest of his life as a slave to his house. The bankers will get rich, yet again.

The whole point of all of the Mortgage Mod Plans and Purchase Plans is to try and get cash into the hands of consumers – just like they did it is 2003. You can see how the Fed is creating a Credit Bubble that is several times larger than the one that just popped.

The issue for me is that the last go around, the bonds were purchased by Hedge Funds and Banks – now they are being bought by the US Treasury and US Agencies (SIVs to the US Government Balance Sheet). The Dollar is toast - it is simply a matter of when, not if. Your Dollar-denominated asset (like Real Estate) are going to get crushed... You had better find ways of hedging for a falling Dollar.

So how is this all going to end?

I came across an interview of Peter Boockvar today on Bloomberg (ht zerohedge). This is not me being interviewed, but he sure uses a lot of my phrases.

http://www.clipsyndicate.com/video/play/1004277

“Inflation is the symptom of a weak currency.”

“There’s this Global race to debase one’s currency, in order to inflate our way out of this mess. Gold is a beneficiary of that.”

The market is “betting" that inflation “will come”.

“Ben Bernanke and the Fed are not going to stop, until this economy gains traction.”

“If the economy gets better, then inflation is going to follow us like this dark shadow.”

“The S&P 500 is up 15% since the middle of March. The CRB Index (Commodities) is up 15%. So on an inflation adjusted term, the market has done nothing since the middle of March. This is an inflation-type rally, egged on by the Fed’s Quantitative Easing and printing of money.”

“There are 3 different ways of dealing with the debt that we have – you can pay it down, you can write it off or you can inflate your way out. The Fed has chosen the third (I have been saying exactly the same thing for years).”

“By inflating your way out – by artificially keeping rates low, you’re preventing the deleveraging process from occurring. If I cut rates to zero, you’re not going to pay down debt - you’re just going to refinance it. You’re going to push it out to 2012, instead of 2010. WE ARE KICKING THE CAN DOWN THE ROAD (capitalized by me for emphasis). That’s what the Fed is doing.

We need to extinguish debt in this country… but all we are doing is refinancing – a loan modification. It’s just a refinancing .

People should be renting, that can’t afford to live in (an existing home). We are kicking the can down the road. It’s going to be good for Gold, because there is going to be constantly more printing of money.”

“We’ve seen a pullback in spending because demand is not there. The economy needs to readjust. So, the Government is trying to put Humpty Dumpty back together again (I know I wrote this line in several previous posts). And it’s not going to happen. Because the consumer can’t handle any more debt, businesses can’t handle any more debt and right now the government can – because foreigners and investors are buying it, but who knows how much longer that will last.”

“We are on a dangerous path right now and unfortunately, I don’t think the Fed fully understands. They are living in this World where there’s Deflation – Janet Yellen last night said that she’s more worried that inflation is going to stay low for years. Gold is 7% from $1,000 and you have a Fed member who is saying that Inflation is not a concern… One of them will be wrong.

I love this guy. I will be reading him in the future and linking what I think is beneficial.

China wants a new reserve currency to be brought up at the next G8 meeting. I have news for them, we already have one – and it is called Gold.

This is the endgame to Obama bringing in yet another Wall Street clown to run the Fed – Geithner. I warned you this was coming. Just keep kicking the can down the road. China is pissed.

http://www.cnbc.com/id/31685244

Here is a chart of the delinquency rates for mortgages by year of origination. As you can see, the delinquency rates for 2007 and 2008 are parabolic. Not a good sign if you are a lender… Freddie and Fannie are lending on behalf of the US Taxpayer.

I think the average default rate for defaulted mortgages that were restructured last year is already above 50%. It might be 60%, I am not certain. I am certain that a lot of those were factored into this chart.

Why is The Fed Doing This (with our money)?

Housing prices have imploded and that has put a lot of homeowners in a position of Negative Equity (your mortgage is worth more than your house).

This chart of inflation-adjusted housing prices is what is referred to as an “Eiffel Tower Top” – straight up and straight down.

The implosion in housing prices has made it impossible for homeowners with negative equity to refinance their homes. Think of all the people who have variable rate mortgages that will reset to much higher rates in 2009 – 2011. They are toast if they can’t refinance. That is an enormous pile of losses that will bankrupt a lot of banks.

Look at how many people now have negative equity (Loan to value > 100%)! If housing prices still have farther to fall (The chart above shows you that prices can still fall another 30% before reaching their historic levels of affordability.

Mortgages are now an incredibly large part of the Bond Market. That means that they are owned by lots of Pension Plans, Mutual Funds, Insurance Companies, Banks and Individual Investors. The Fed feels compelled to not allow these bonds to default and is now going to refinance existing loans at any cost.

The Fed is already buying Mortgages from those same investors. They have already bought nearly $970 billion of them. Notice the maturity dates of these purchased mortgages. They are all fairly short term paper (6 years or less). That means the Fed has been buying variable mortgages – the toxic crap that is virtually worthless.

There is no way to know exactly what was paid for it, but you can bet the boys at PIMCO and Blackrock made a killing. The Fed will now try and refi a huge percentage of this debt via this new program.

You are probably wondering why this is such a bad idea – I mean it keep people in their houses, right?

I’m just going to do the math to show you how what the Fed is doing is propping up real estate prices for as long as they can.

Say you have a $100,000 ARM and it will recast in 2009. Your current Interest Rate is 4% and it will recast at 9%.

Your current monthly payment is $333

Your monthly payment starting in January 2010 will be $804

But Uncle Sam has been artificially holding rates down by buying $960 billion in Mortgages and another $330 billion in US Treasuries to help you refi at these below-market rates.

So you can now refi at 5.3% on a 30-year Fixed and have a monthly payment of only $555 per month. That is a lot more than $333, but it will allow a lot of people to stay in their houses.

Is that a Good Thing?

The claim is that the Government is doing this to make housing “more affordable” – bs.

How do you make things more affordable by making credit artificially cheap?

If I make $100k and I want to buy a house, the old matrix was that I could spend 28% of my income on the cost of housing (mortgage, insurance and taxes). The average now is 40% - even after the collapse in housing prices.

That would mean that at a 7% interest rate (where things would probably be right now without Government intervention in the Credit Market), I would be able to buy a house worth $435k.

However, at 5.3%, I would be able to buy a home worth $521,100. The lower rates are artificailly propping up prices by 20%. How the heck does capping Interest Rates make housing more affordable? It doesn’t, of course.

My concern is that some yutz is going to refi a house he can’t afford at 125% Loan to Value and the poor slob will spend the rest of his life as a slave to his house. The bankers will get rich, yet again.

The whole point of all of the Mortgage Mod Plans and Purchase Plans is to try and get cash into the hands of consumers – just like they did it is 2003. You can see how the Fed is creating a Credit Bubble that is several times larger than the one that just popped.

The issue for me is that the last go around, the bonds were purchased by Hedge Funds and Banks – now they are being bought by the US Treasury and US Agencies (SIVs to the US Government Balance Sheet). The Dollar is toast - it is simply a matter of when, not if. Your Dollar-denominated asset (like Real Estate) are going to get crushed... You had better find ways of hedging for a falling Dollar.

So how is this all going to end?

I came across an interview of Peter Boockvar today on Bloomberg (ht zerohedge). This is not me being interviewed, but he sure uses a lot of my phrases.

http://www.clipsyndicate.com/video/play/1004277

“Inflation is the symptom of a weak currency.”

“There’s this Global race to debase one’s currency, in order to inflate our way out of this mess. Gold is a beneficiary of that.”

The market is “betting" that inflation “will come”.

“Ben Bernanke and the Fed are not going to stop, until this economy gains traction.”

“If the economy gets better, then inflation is going to follow us like this dark shadow.”

“The S&P 500 is up 15% since the middle of March. The CRB Index (Commodities) is up 15%. So on an inflation adjusted term, the market has done nothing since the middle of March. This is an inflation-type rally, egged on by the Fed’s Quantitative Easing and printing of money.”

“There are 3 different ways of dealing with the debt that we have – you can pay it down, you can write it off or you can inflate your way out. The Fed has chosen the third (I have been saying exactly the same thing for years).”

“By inflating your way out – by artificially keeping rates low, you’re preventing the deleveraging process from occurring. If I cut rates to zero, you’re not going to pay down debt - you’re just going to refinance it. You’re going to push it out to 2012, instead of 2010. WE ARE KICKING THE CAN DOWN THE ROAD (capitalized by me for emphasis). That’s what the Fed is doing.

We need to extinguish debt in this country… but all we are doing is refinancing – a loan modification. It’s just a refinancing .

People should be renting, that can’t afford to live in (an existing home). We are kicking the can down the road. It’s going to be good for Gold, because there is going to be constantly more printing of money.”

“We’ve seen a pullback in spending because demand is not there. The economy needs to readjust. So, the Government is trying to put Humpty Dumpty back together again (I know I wrote this line in several previous posts). And it’s not going to happen. Because the consumer can’t handle any more debt, businesses can’t handle any more debt and right now the government can – because foreigners and investors are buying it, but who knows how much longer that will last.”

“We are on a dangerous path right now and unfortunately, I don’t think the Fed fully understands. They are living in this World where there’s Deflation – Janet Yellen last night said that she’s more worried that inflation is going to stay low for years. Gold is 7% from $1,000 and you have a Fed member who is saying that Inflation is not a concern… One of them will be wrong.

I love this guy. I will be reading him in the future and linking what I think is beneficial.

China wants a new reserve currency to be brought up at the next G8 meeting. I have news for them, we already have one – and it is called Gold.

Monday, June 29, 2009

Mor on California

I have had a couple of questions today about Municipal Bonds and the potential for a Default by California on its debt. From what I have read, California cannot default on its Municipal Bonds, nor can it just stop paying its education bills. However, California can stop making payments to counties and cities and they can be forced to default on their debt.

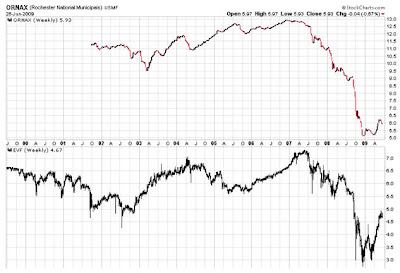

Here is a chart of a mutual fund holding Municipal Bonds from around the nation. I compare this fund to the chart of the 30-year US Treasury, because it gives you a clear picture of how the market perceives the credit quality of the Fund versus the “safe” US Treasury.

When the Credit Markets cracked in September 2008, this fund tanked and US Treasury when vertical. The trends reversed at the end of 2008 and the US Treasury now sits at a significant support level.

I am more inclined to buy treasuries here, than sell. Therefore, I would be more inclined to sell Muni’s than buy.

You second type of municipal bond fund shows some gruesome performance. It is basically what is referred to as a “floating rate” fund. These funds how high-yield (junk) bonds, whose interest rates reset every 30 days. They tend to get trashed during recessions and then have decent returns as interest rates increase during economic expansion. I am not sure how much upside they will have in this recovery.

I have included a chart of a corporate “floating rate fund” (EVF) for comparison. EVF has rallied 60% since the March 2009 lows – I don’t think there is much upside over the near term.

The bottom line is this – California can issue a lot of new bonds any time it wants. It will simply have to offer the bonds at interest rates substantially above where they are now. The Fed is artificially holding rates down by printing money, because nobody in their right mind is willing to buy bonds at these current interest rates. Just something to consider if you own a lot of Muni Bonds…

Here is a chart of a mutual fund holding Municipal Bonds from around the nation. I compare this fund to the chart of the 30-year US Treasury, because it gives you a clear picture of how the market perceives the credit quality of the Fund versus the “safe” US Treasury.

When the Credit Markets cracked in September 2008, this fund tanked and US Treasury when vertical. The trends reversed at the end of 2008 and the US Treasury now sits at a significant support level.

I am more inclined to buy treasuries here, than sell. Therefore, I would be more inclined to sell Muni’s than buy.

You second type of municipal bond fund shows some gruesome performance. It is basically what is referred to as a “floating rate” fund. These funds how high-yield (junk) bonds, whose interest rates reset every 30 days. They tend to get trashed during recessions and then have decent returns as interest rates increase during economic expansion. I am not sure how much upside they will have in this recovery.

I have included a chart of a corporate “floating rate fund” (EVF) for comparison. EVF has rallied 60% since the March 2009 lows – I don’t think there is much upside over the near term.

The bottom line is this – California can issue a lot of new bonds any time it wants. It will simply have to offer the bonds at interest rates substantially above where they are now. The Fed is artificially holding rates down by printing money, because nobody in their right mind is willing to buy bonds at these current interest rates. Just something to consider if you own a lot of Muni Bonds…

Friday, June 26, 2009

I love California, but man have we messed it up…

Last week, Moody’s and Standard & Poor’s threatened to downgrade California’s Credit Rating. Today Fitch CUT California’s Credit Rating – it already was the lowest rated debt in the nation and now is but a few levels above Junk.

The downgrades will make it more expensive for California to sell future bonds. I am sure that Barney Frank will now want to use Federal money to guarantee California Muni Bonds…

California had ample time to fix things, but chose not to and now California Municipal Bond Investors are the ones at risk.

Here are some ideas of how California will fix its financing problems –

Increase withholdings ($2.3 billion) – but they have to refund it next April

Pay State Employees on July 1st, instead of June 30th ($1.2 billion) – California’s Fiscal Year ends on June 30th

Do the same with education funding ($1.8 billion) – add both to next year’s Budget

America at its finest – kick the can down the road and make the next guy have to deal with it – and keep collecting all the bribes and kickbacks…

California’s Revenue is $24 billion less than its Expenses. At some point, we have to spend as much as we make. But the politicians are obsessed with the idea that they don’t have to make any cuts and they can use accounting tricks and borrowing to keep sustainable Expenses way above sustainable Revenue.

Ultimately, the Bond Market will veto the politicians as investors stop buying the debt or stop buying it at low Interest Rates.

Without a Federal Bailout or temporary Federal backing of California debt, California will start defaulting in about 30 days.

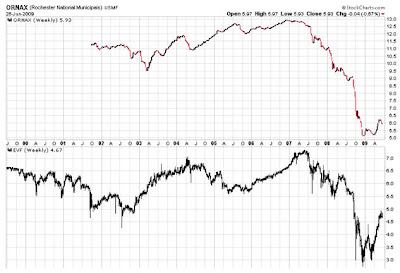

Here is a chart of what has historically been the best selling California municipal Bond Fund. It rallied nicely from 1990 – 2002, as Interest Rates fell, but has now broken down from an 8-year topping pattern. For the first time in over 20 years, the 1-yr (Blue Line) sits below the 2-yr (Red Line). That is a Bear Market – get used to a Bear Market in Bonds.

Here is a weekly chart of the same fund. The breakdown was at $6.90 (Blue Line). If you have been reading my blog for a while, then you know that the two green lines make a bearish wedge and if you hold this fund you should be losing sleep.

Short of Obama forcing the US Taxpayer to eat California’s debt, this fund is toast. I used to believe that you could ignore the actions of Government, because all they ever seemed to do was screw things up. Now I understand the greed of our Politicians and know that they can be bought to misappropriate public funds.

Understand this though, that even if Obama does bail out California, he will not fix the root problems of this mess and the markets will crush long term Bond Prices either via defaults or via skyrocketing Interest Rates. The Government has shown their propensity to kicking the can down the road, so a Federal Bailout of California seems a likely outcome. That said, I would still not own too much (if any) California Muni Debt!

The downgrades will make it more expensive for California to sell future bonds. I am sure that Barney Frank will now want to use Federal money to guarantee California Muni Bonds…

California had ample time to fix things, but chose not to and now California Municipal Bond Investors are the ones at risk.

Here are some ideas of how California will fix its financing problems –

Increase withholdings ($2.3 billion) – but they have to refund it next April

Pay State Employees on July 1st, instead of June 30th ($1.2 billion) – California’s Fiscal Year ends on June 30th

Do the same with education funding ($1.8 billion) – add both to next year’s Budget

America at its finest – kick the can down the road and make the next guy have to deal with it – and keep collecting all the bribes and kickbacks…

California’s Revenue is $24 billion less than its Expenses. At some point, we have to spend as much as we make. But the politicians are obsessed with the idea that they don’t have to make any cuts and they can use accounting tricks and borrowing to keep sustainable Expenses way above sustainable Revenue.

Ultimately, the Bond Market will veto the politicians as investors stop buying the debt or stop buying it at low Interest Rates.

Without a Federal Bailout or temporary Federal backing of California debt, California will start defaulting in about 30 days.

Here is a chart of what has historically been the best selling California municipal Bond Fund. It rallied nicely from 1990 – 2002, as Interest Rates fell, but has now broken down from an 8-year topping pattern. For the first time in over 20 years, the 1-yr (Blue Line) sits below the 2-yr (Red Line). That is a Bear Market – get used to a Bear Market in Bonds.

Here is a weekly chart of the same fund. The breakdown was at $6.90 (Blue Line). If you have been reading my blog for a while, then you know that the two green lines make a bearish wedge and if you hold this fund you should be losing sleep.

Short of Obama forcing the US Taxpayer to eat California’s debt, this fund is toast. I used to believe that you could ignore the actions of Government, because all they ever seemed to do was screw things up. Now I understand the greed of our Politicians and know that they can be bought to misappropriate public funds.

Understand this though, that even if Obama does bail out California, he will not fix the root problems of this mess and the markets will crush long term Bond Prices either via defaults or via skyrocketing Interest Rates. The Government has shown their propensity to kicking the can down the road, so a Federal Bailout of California seems a likely outcome. That said, I would still not own too much (if any) California Muni Debt!

Greenspan Speaks

Over the years, I have spent a lot of time analyzing the writings of Ben Bernanke. Several of his key speeches have proven to be roadmaps for economic policy.

Now, Alan Greenspan has written a piece that should prove to be the roadmap for the next decade -

http://www.ft.com/cms/s/0/e1fbc4e6-6194-11de-9e03-00144feabdc0.html?nclick_check=1

Let’s rip it apart –

Asset Price Appreciation is the Key to Economic Recovery

“The rise in global stock prices from early March to mid-June is arguably the primary cause of the surprising positive turn in the economic environment.”

“I recognize that I accord a much larger economic role to equity prices than is the conventional wisdom. From my perspective, they are not merely an important leading indicator of global business activity, but a major contributor to that activity, operating primarily through balance sheets…”

“…a significant driver of stock prices is the innate human propensity to swing between euphoria and fear, which, while heavily influenced by economic events, has a life of its own. In my experience, such episodes are often not mere forecasts of future business activity, but major causes of it.”

Does this really surprise anybody? I have told you for years now that Asset Price Appreciation is a policy tool which is used to mask the real pains of the underlying economy – drive Asset Prices up, over-tax those who hold the assets and increase entitlements to placate those who don’t hold assets.

A chart from econompicdata.blogspot.com shows the reality of what has occurred in the Job Market over the last decade. That’s right, 6 million Manufacturing Jobs lost. The offset has been a 3 million job increase in Government Jobs and 1.5 million new jobs at Starbucks and McDonald’s. Holy cow…

Obama was elected to reverse this. He has been an epic failure. The Middle Class is still gutted. As Manufacturing Jobs went overseas, Manufacturing Workers went into the Construction business. This worked as the Real Estate Market was driven to excess via cheap lending to unqualified borrowers – but now we are left with millions of unemployed workers, about 2 years of excess housing inventory and the US Taxpayer in now on the hook for an additional $10 trillion in new Debt and Loan Guarantees to the banks.

Nobody at these banks is being prosecuted because the government needed them to lend to people who couldn’t afford to buy their houses. They were (are) all in on this together – technocrats and greedy policy makers trying to create the perfect economy to take care of the perfect storm that is the retirement of the Baby Boom.

Think about this – if asset price appreciation is the key to recapitalizing the banks, then it is also the key to recapitalizing the US Treasury. We could be in for one mother of a Bull Market…

Recapitalize Corporate America

“The $12,000bn of newly created corporate equity value has added significantly to the capital buffer that supports the debt issued by financial and non-financial companies… Previously capital-strapped companies have been able to raise considerable debt and equity in recent months. Market fears of bank insolvency, particularly, have been assuaged.”

“…huge unrecognized losses of US banks still need to be funded. Either a stabilization of home prices or a further rise in newly created equity value available to US financial intermediaries would address this impediment to recovery.”

Greenspan sticks to his old playbook – get Stock Prices up, ignite the “Wealth Effect” and greed will drive the leverage that buoys other asset prices – Stocks drive Real Estate Prices, Wall Street drives the Economy.

Where Are Stocks Going?

“Global stock markets have rallied so far and so fast this year that it is difficult to imagine they can proceed further at anywhere near their recent pace. But what if, after a correction, they proceeded inexorably higher? That would bolster global balance sheets with large amounts of new equity value and supply banks with the new capital that would allow them to step up lending. Higher share prices would also lead to increased household wealth and spending, and the rising market value of existing corporate assets (proxied by stock prices) relative to their replacement cost would spur new capital investment. Leverage would be materially reduced. A prolonged recovery in global equity prices would thus assist in the lifting of the deflationary forces that still hover over the global economy.”

Do you think Greenspan wrote this without a clear understanding of where things are going?

Ramping the Stock Market is very simply the cheapest way to save the Economy – and let the next Administration worry about cleaning up this credit-driven mess. Do you see why I am getting so Bullish about buying the next dip?

Inflation

“For the benevolent scenario above to play out, the short-term dangers of deflation and longer-term dangers of inflation have to be confronted and removed. Excess capacity is temporarily suppressing global prices. But I see inflation as the greater future challenge.”

“Inflation is a special concern over the next decade given the pending avalanche of government debt about to be unloaded on world financial markets. The need to finance very large fiscal deficits during the coming years could lead to political pressure on central banks to print money to buy much of the newly issued debt.”

All this New Money creation will lead to inflation, unless we have a rational government that pulls the plug on the Cheap Money before things get out of hand.

“The Federal Reserve, when it perceives that the unemployment rate is poised to decline, will presumably start to allow its short-term assets to run off…”

“If political pressures prevent central banks from reining in their inflated balance sheets in a timely manner, statistical analysis suggests the emergence of inflation by 2012; earlier if markets anticipate a prolonged period of elevated money supply.”

“Thus, interest rates would rise well before the restoration of full employment, a policy that, in the past, has not been viewed favorably by Congress.”

Do you really think Congress has the desire to allow the Fed to raise Interest Rates in a timely manner? Can you imagine a Congressman going home and telling his voters that he is sorry they lost their job, but that lumps had to be taken to prevent large damage down the road?

Rising Interest Rates

“…unless US government spending commitments are stretched out or cut back, real interest rates will be likely to rise even more, owing to the need to finance the widening deficit.”

“Government spending commitments over the next decade are staggering... Historically, the US, to limit the likelihood of destructive inflation, relied on a large buffer between the level of federal debt and rough measures of total borrowing capacity. Current debt issuance projections, if realized, will surely place America precariously close to that notional borrowing ceiling. Fears of an eventual significant pick-up in inflation may soon begin to be factored into longer-term US government bond yields, or interest rates.”

“The US is faced with the choice of either paring back its budget deficits and monetary base as soon as the current risks of deflation dissipate, or setting the stage for a potential upsurge in inflation.”

The US Government will overspend and that will lead to US Treasuries getting crushed in the bond market as foreign investors look elsewhere to stash their money. Look at how far prices can fall when rates eventually do rise –

This is just my opinion – but you are nuts if you are buying or holding 30-year Bonds right now. You should also be strongly considering refinancing into 30-year Mortgages at these artificially low Interest Rates. If your mortgage is 5% and inflation averages 10% for the next decade, then the real cost of your mortgage will fall by something like 40%. I expect a similar real loss in 30-year Bonds. I would expect the same from 30-year Triple Net Lease properties as well.

Government vs Free Capital Markets

“Should real long-term interest rates become chronically elevated, share prices, if history is any guide, will remain suppressed.”

Greenspan is warning Congress to not kill the Gold-laying Goose. Without the Wall Street Casino to drive the Wealth Effect, Washington would have to make tough decisions about real sacrifice – and that is unacceptable to our Baby Boom leaders.

“Even absent the inflation threat, there is another potential danger inherent in current US fiscal policy: a major increase in the funding of the US economy through public sector debt. Such a course for fiscal policy is a recipe for the political allocation of capital and an undermining of the process of “creative destruction” – the private sector market competition that is essential to rising standards of living.”

“…for the best chance for worldwide economic growth we must continue to rely on private market forces to allocate capital and other resources. The alternative of political allocation of resources has been tried; and it failed.”

The Nationalization camel now has his nose in the tent, and the politicians just won’t be able to help themselves. Each time a new industry or politically connected company gets into trouble, the Government will step in to save the day.

The problem is that there is finite amount of risk capital in the economy. The decisions for how to deploy it used to be made by using a model of potential risk and potential profit. Then the credit bubble was unleashed and leverage made it much easier to fund many more projects. Now the Government is creating its own leverage, but instead of using the newly created capital to make profits, the government is using the money to effectively buy votes – and what could be more profitable for a Politician?

Now, Alan Greenspan has written a piece that should prove to be the roadmap for the next decade -

http://www.ft.com/cms/s/0/e1fbc4e6-6194-11de-9e03-00144feabdc0.html?nclick_check=1

Let’s rip it apart –

Asset Price Appreciation is the Key to Economic Recovery

“The rise in global stock prices from early March to mid-June is arguably the primary cause of the surprising positive turn in the economic environment.”

“I recognize that I accord a much larger economic role to equity prices than is the conventional wisdom. From my perspective, they are not merely an important leading indicator of global business activity, but a major contributor to that activity, operating primarily through balance sheets…”

“…a significant driver of stock prices is the innate human propensity to swing between euphoria and fear, which, while heavily influenced by economic events, has a life of its own. In my experience, such episodes are often not mere forecasts of future business activity, but major causes of it.”

Does this really surprise anybody? I have told you for years now that Asset Price Appreciation is a policy tool which is used to mask the real pains of the underlying economy – drive Asset Prices up, over-tax those who hold the assets and increase entitlements to placate those who don’t hold assets.

A chart from econompicdata.blogspot.com shows the reality of what has occurred in the Job Market over the last decade. That’s right, 6 million Manufacturing Jobs lost. The offset has been a 3 million job increase in Government Jobs and 1.5 million new jobs at Starbucks and McDonald’s. Holy cow…

Obama was elected to reverse this. He has been an epic failure. The Middle Class is still gutted. As Manufacturing Jobs went overseas, Manufacturing Workers went into the Construction business. This worked as the Real Estate Market was driven to excess via cheap lending to unqualified borrowers – but now we are left with millions of unemployed workers, about 2 years of excess housing inventory and the US Taxpayer in now on the hook for an additional $10 trillion in new Debt and Loan Guarantees to the banks.

Nobody at these banks is being prosecuted because the government needed them to lend to people who couldn’t afford to buy their houses. They were (are) all in on this together – technocrats and greedy policy makers trying to create the perfect economy to take care of the perfect storm that is the retirement of the Baby Boom.

Think about this – if asset price appreciation is the key to recapitalizing the banks, then it is also the key to recapitalizing the US Treasury. We could be in for one mother of a Bull Market…

Recapitalize Corporate America

“The $12,000bn of newly created corporate equity value has added significantly to the capital buffer that supports the debt issued by financial and non-financial companies… Previously capital-strapped companies have been able to raise considerable debt and equity in recent months. Market fears of bank insolvency, particularly, have been assuaged.”

“…huge unrecognized losses of US banks still need to be funded. Either a stabilization of home prices or a further rise in newly created equity value available to US financial intermediaries would address this impediment to recovery.”

Greenspan sticks to his old playbook – get Stock Prices up, ignite the “Wealth Effect” and greed will drive the leverage that buoys other asset prices – Stocks drive Real Estate Prices, Wall Street drives the Economy.

Where Are Stocks Going?

“Global stock markets have rallied so far and so fast this year that it is difficult to imagine they can proceed further at anywhere near their recent pace. But what if, after a correction, they proceeded inexorably higher? That would bolster global balance sheets with large amounts of new equity value and supply banks with the new capital that would allow them to step up lending. Higher share prices would also lead to increased household wealth and spending, and the rising market value of existing corporate assets (proxied by stock prices) relative to their replacement cost would spur new capital investment. Leverage would be materially reduced. A prolonged recovery in global equity prices would thus assist in the lifting of the deflationary forces that still hover over the global economy.”

Do you think Greenspan wrote this without a clear understanding of where things are going?

Ramping the Stock Market is very simply the cheapest way to save the Economy – and let the next Administration worry about cleaning up this credit-driven mess. Do you see why I am getting so Bullish about buying the next dip?

Inflation

“For the benevolent scenario above to play out, the short-term dangers of deflation and longer-term dangers of inflation have to be confronted and removed. Excess capacity is temporarily suppressing global prices. But I see inflation as the greater future challenge.”

“Inflation is a special concern over the next decade given the pending avalanche of government debt about to be unloaded on world financial markets. The need to finance very large fiscal deficits during the coming years could lead to political pressure on central banks to print money to buy much of the newly issued debt.”

All this New Money creation will lead to inflation, unless we have a rational government that pulls the plug on the Cheap Money before things get out of hand.

“The Federal Reserve, when it perceives that the unemployment rate is poised to decline, will presumably start to allow its short-term assets to run off…”

“If political pressures prevent central banks from reining in their inflated balance sheets in a timely manner, statistical analysis suggests the emergence of inflation by 2012; earlier if markets anticipate a prolonged period of elevated money supply.”

“Thus, interest rates would rise well before the restoration of full employment, a policy that, in the past, has not been viewed favorably by Congress.”

Do you really think Congress has the desire to allow the Fed to raise Interest Rates in a timely manner? Can you imagine a Congressman going home and telling his voters that he is sorry they lost their job, but that lumps had to be taken to prevent large damage down the road?

Rising Interest Rates

“…unless US government spending commitments are stretched out or cut back, real interest rates will be likely to rise even more, owing to the need to finance the widening deficit.”

“Government spending commitments over the next decade are staggering... Historically, the US, to limit the likelihood of destructive inflation, relied on a large buffer between the level of federal debt and rough measures of total borrowing capacity. Current debt issuance projections, if realized, will surely place America precariously close to that notional borrowing ceiling. Fears of an eventual significant pick-up in inflation may soon begin to be factored into longer-term US government bond yields, or interest rates.”

“The US is faced with the choice of either paring back its budget deficits and monetary base as soon as the current risks of deflation dissipate, or setting the stage for a potential upsurge in inflation.”

The US Government will overspend and that will lead to US Treasuries getting crushed in the bond market as foreign investors look elsewhere to stash their money. Look at how far prices can fall when rates eventually do rise –

This is just my opinion – but you are nuts if you are buying or holding 30-year Bonds right now. You should also be strongly considering refinancing into 30-year Mortgages at these artificially low Interest Rates. If your mortgage is 5% and inflation averages 10% for the next decade, then the real cost of your mortgage will fall by something like 40%. I expect a similar real loss in 30-year Bonds. I would expect the same from 30-year Triple Net Lease properties as well.

Government vs Free Capital Markets

“Should real long-term interest rates become chronically elevated, share prices, if history is any guide, will remain suppressed.”

Greenspan is warning Congress to not kill the Gold-laying Goose. Without the Wall Street Casino to drive the Wealth Effect, Washington would have to make tough decisions about real sacrifice – and that is unacceptable to our Baby Boom leaders.

“Even absent the inflation threat, there is another potential danger inherent in current US fiscal policy: a major increase in the funding of the US economy through public sector debt. Such a course for fiscal policy is a recipe for the political allocation of capital and an undermining of the process of “creative destruction” – the private sector market competition that is essential to rising standards of living.”

“…for the best chance for worldwide economic growth we must continue to rely on private market forces to allocate capital and other resources. The alternative of political allocation of resources has been tried; and it failed.”

The Nationalization camel now has his nose in the tent, and the politicians just won’t be able to help themselves. Each time a new industry or politically connected company gets into trouble, the Government will step in to save the day.

The problem is that there is finite amount of risk capital in the economy. The decisions for how to deploy it used to be made by using a model of potential risk and potential profit. Then the credit bubble was unleashed and leverage made it much easier to fund many more projects. Now the Government is creating its own leverage, but instead of using the newly created capital to make profits, the government is using the money to effectively buy votes – and what could be more profitable for a Politician?

Tuesday, June 23, 2009

Lots of Stuff at Support

I’m going to keep this simple tonight. These areas need to hold immediately –

Consumer Discretionary (Retail)

Retail is on the line of death and needs to hold here. Even if it does, there are a lot of recent leaders that are now broken and will not help the sector advance.

Consumer Staples

The stuff you use every day is also at critical support and needs to hold.

Financials

Banks need to rally ASAP, if the markets are going to rally into the end of June.

The Dow Jones 30

The Dow is at support and needs to hold here or things get real bad, real fast.

Unless the Fed does something truly stupid tomorrow, I think stocks can attempt to recapture their recent highs into Quarter End. Then you have July 4th a few days later, so you could have a light-volume environment in which to accelerate price moves.

We’ll see how it plays out. The issues is how will they bounce – what bounces and by how much? Watch the leaders of this move – China (FXI), BIDU, Goldman Sachs (GS), Apple (AAPL)… And the big financials - BAC, WFC, JPM…

Lots of areas and stocks have already broken down. So you are starting to see the Bullish Percent Indicator fall, as fewer stocks remain in uptrends. That weakening of the internals of the market is what leads to corrections – or worse.

I still think that this retest is the final retest of the Bear Market lows and the next leg up will be driven by Commodities and anti-Dollar trades. I expect to be able to buy and hold for an extended period on any weakness this Summer and Fall. If things change, I will let you know.

Consumer Discretionary (Retail)

Retail is on the line of death and needs to hold here. Even if it does, there are a lot of recent leaders that are now broken and will not help the sector advance.

Consumer Staples

The stuff you use every day is also at critical support and needs to hold.

Financials

Banks need to rally ASAP, if the markets are going to rally into the end of June.

The Dow Jones 30

The Dow is at support and needs to hold here or things get real bad, real fast.

Unless the Fed does something truly stupid tomorrow, I think stocks can attempt to recapture their recent highs into Quarter End. Then you have July 4th a few days later, so you could have a light-volume environment in which to accelerate price moves.

We’ll see how it plays out. The issues is how will they bounce – what bounces and by how much? Watch the leaders of this move – China (FXI), BIDU, Goldman Sachs (GS), Apple (AAPL)… And the big financials - BAC, WFC, JPM…

Lots of areas and stocks have already broken down. So you are starting to see the Bullish Percent Indicator fall, as fewer stocks remain in uptrends. That weakening of the internals of the market is what leads to corrections – or worse.

I still think that this retest is the final retest of the Bear Market lows and the next leg up will be driven by Commodities and anti-Dollar trades. I expect to be able to buy and hold for an extended period on any weakness this Summer and Fall. If things change, I will let you know.

Thursday, June 18, 2009

Quarter End Fast Approaching

We are heading into the end of the Month and the end of the Quarter. Last month saw a huge move up in its last few days and a 1% gain in the last few minutes of trading.

NYSE

The NYSE ($NYA) has broken below its 20-day (Green Line) for the first time in mid-March. The NYSE is a very broad index covering over 2,000 US and Foreign stocks.

The broad market has gone nowhere for 7 weeks.

NYSE 6-month Chart

This is a very busy chart, but I want to take a detailed look at the broad market -

The NYSE tracked the 20-day (Green Line) during this rally, where every time it touched the 20-day, it rallied higher (Green Arrows). NYSE broke the 20-day on Tuesday

The last 3 days of May were a Futures-driven moon shot to make May Statements look better (Black Arrow and Box)

NYSE spent most of June in a narrow trading range. It tried to break out and failed and has now broken down. Support now lies at the 50-day (Blue Line) and the 200-day (Black Line)

Everybody seems to be expecting a pullback. The logical levels are 5,431 and 5,191 as support

NASDAQ 100 (QQQQ) has pulled into its 20-day. QQQQ has been the leader on this rally, so it will need to be watched very closely. A 50% retracement of the recent rally would take QQQQ back to the old breakout point (Red Line).

Lots of leadership has pulled back into logical support, so pay close attention to these names –

Apple (AAPL)

Apple has been sitting on its 20-day for 4 trading days and should make a violent move very soon (beware, Apple is a volatile stock). Keep in mind that RIMM comes out with numbers today, so anything can happen.

My guess is that the Institutions that hold Apple will try and defend their gains into the end of the Quarter. A logical assumption is that they take Apple up to challenge the highs of early May and then blast it. I will be looking for divergences on any rally. If Apple fails here, then next support is $130.

Commodities have been leading and may finally be pulling back into support for a better entry point -

Gold (GLD) has pulled back nicely over the past 2 weeks, and now sits on its 50-day (Black Arrow and Line). A break above 97.5 would be a breakout from a 16-month base.

Freeport MacMoran (FCX) has been the leader for commodity stocks and has now pulled back to its 50-day (Black Line). FCX is down 17% in 6 days, but is still in an uptrend.

I am very interested in Biotech, with BBH trying to break out of a 4-year base.

I still consider this to be a trading environment for stocks, until the markets have some sort of retest of the March lows. I consider any pullbacks to be places at which I can add to holdings in Gold and Commodities.

NYSE

The NYSE ($NYA) has broken below its 20-day (Green Line) for the first time in mid-March. The NYSE is a very broad index covering over 2,000 US and Foreign stocks.

The broad market has gone nowhere for 7 weeks.

NYSE 6-month Chart

This is a very busy chart, but I want to take a detailed look at the broad market -

The NYSE tracked the 20-day (Green Line) during this rally, where every time it touched the 20-day, it rallied higher (Green Arrows). NYSE broke the 20-day on Tuesday

The last 3 days of May were a Futures-driven moon shot to make May Statements look better (Black Arrow and Box)

NYSE spent most of June in a narrow trading range. It tried to break out and failed and has now broken down. Support now lies at the 50-day (Blue Line) and the 200-day (Black Line)

Everybody seems to be expecting a pullback. The logical levels are 5,431 and 5,191 as support

NASDAQ 100 (QQQQ) has pulled into its 20-day. QQQQ has been the leader on this rally, so it will need to be watched very closely. A 50% retracement of the recent rally would take QQQQ back to the old breakout point (Red Line).

Lots of leadership has pulled back into logical support, so pay close attention to these names –

Apple (AAPL)

Apple has been sitting on its 20-day for 4 trading days and should make a violent move very soon (beware, Apple is a volatile stock). Keep in mind that RIMM comes out with numbers today, so anything can happen.

My guess is that the Institutions that hold Apple will try and defend their gains into the end of the Quarter. A logical assumption is that they take Apple up to challenge the highs of early May and then blast it. I will be looking for divergences on any rally. If Apple fails here, then next support is $130.

Commodities have been leading and may finally be pulling back into support for a better entry point -

Gold (GLD) has pulled back nicely over the past 2 weeks, and now sits on its 50-day (Black Arrow and Line). A break above 97.5 would be a breakout from a 16-month base.

Freeport MacMoran (FCX) has been the leader for commodity stocks and has now pulled back to its 50-day (Black Line). FCX is down 17% in 6 days, but is still in an uptrend.

I am very interested in Biotech, with BBH trying to break out of a 4-year base.

I still consider this to be a trading environment for stocks, until the markets have some sort of retest of the March lows. I consider any pullbacks to be places at which I can add to holdings in Gold and Commodities.

Subscribe to:

Posts (Atom)